Cassey Tash

Lister

A PIN is a personal identification number used by individuals or companies to do business with the government agencies and Kenya Revenue Authority.

One is required to have a pin for the following reasons;

1. When you wish to apply for students loan commonly known as HELB

2. If you are employed; Have a pin will help you pay your taxes and file for your returns every financial year.

3. If you have/wants to start a business;

4. Have rental incomes;

Requirements for a PIN registration

1. National IDs/ Alien ID card details - Ensure you have your National Id, that's if you're not sure of your personal details, your parents, and spouse if any. You'll need their details such as date of birth, Government name, place of birth and their National ID numbers to fill in the online form.

2. Employers' details, if employed - This includes their PIN, name of the employer, day time mobile number and a physical address

3. For those in business, you'll need business registration certificate details.

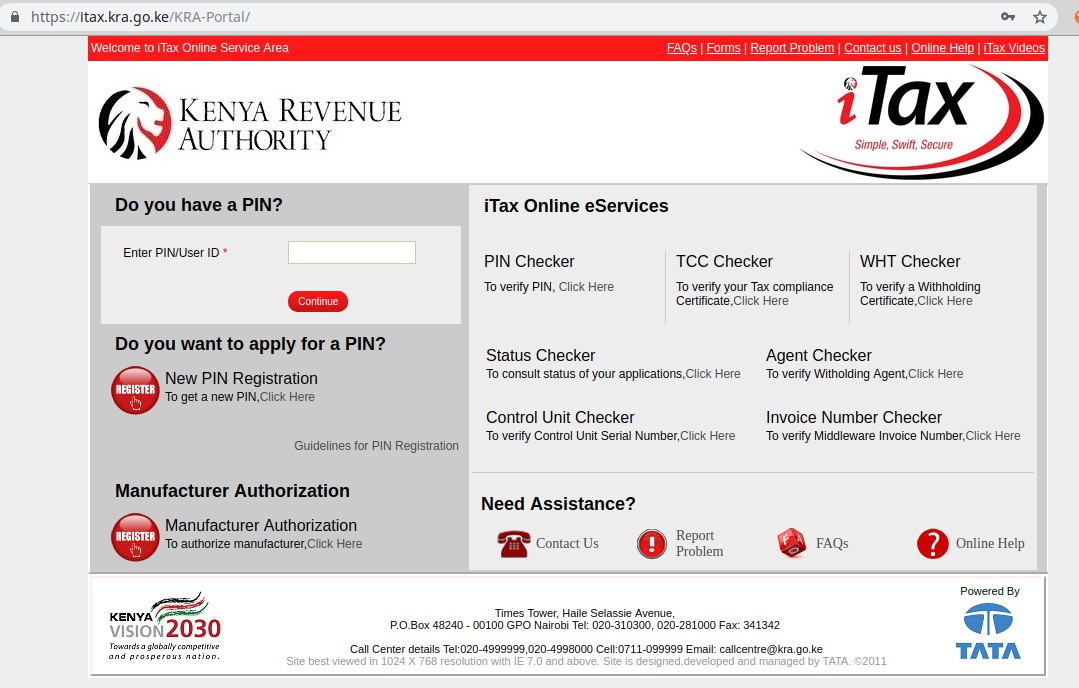

After obtaining all the above, visit itax.kra.go.ke, click on new PIN registration

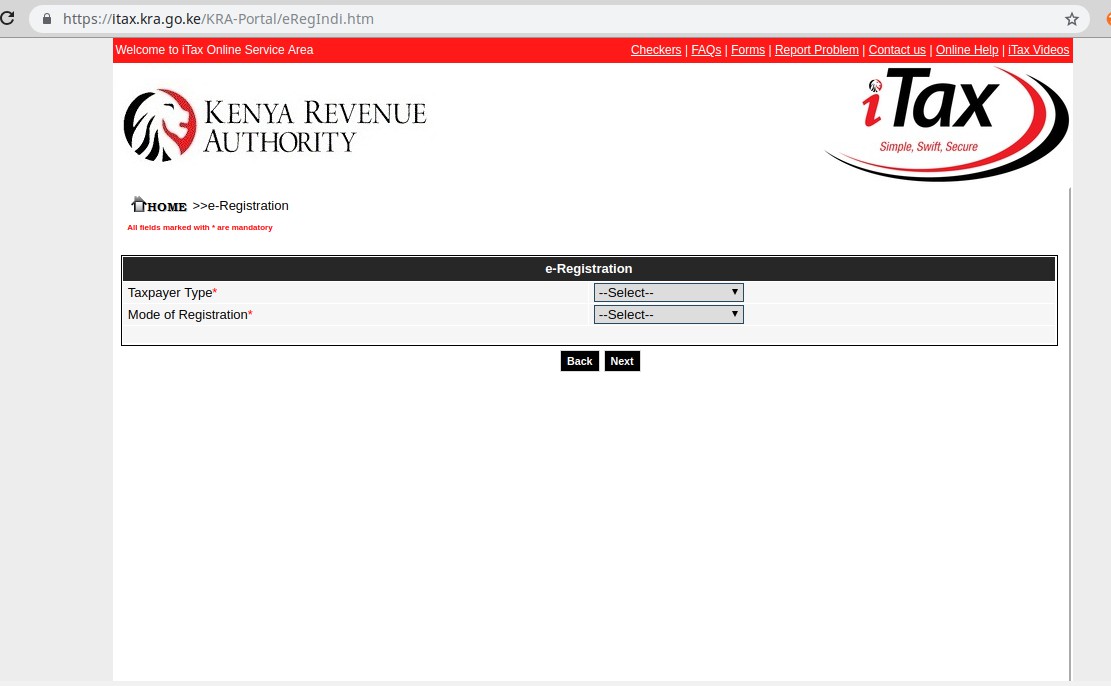

For your business pin, on the type of tax, select non-individual, and for your personal use, select individual, on the mode of registration, select online upload as shown below, on completion, click next

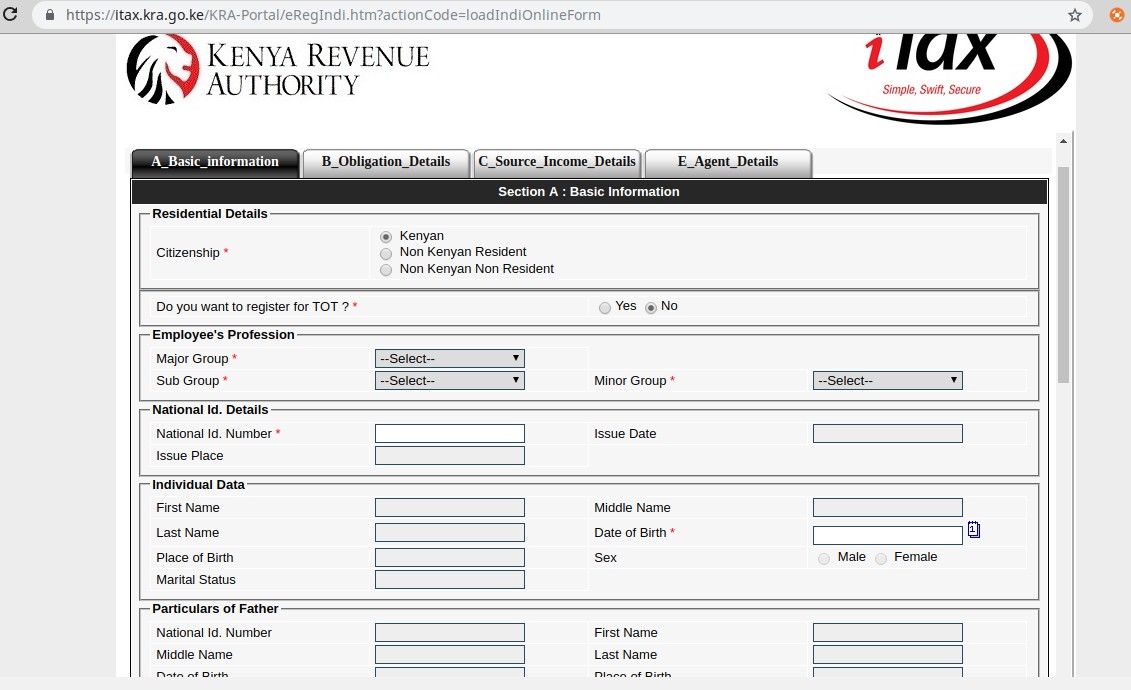

In this next step you'll fill in your personal information, or Basic information as shown below, ensure all the tab on this page has correct information. That is the Obligation, source of income, and agent details. (Below picture shows individual taxpayer form)

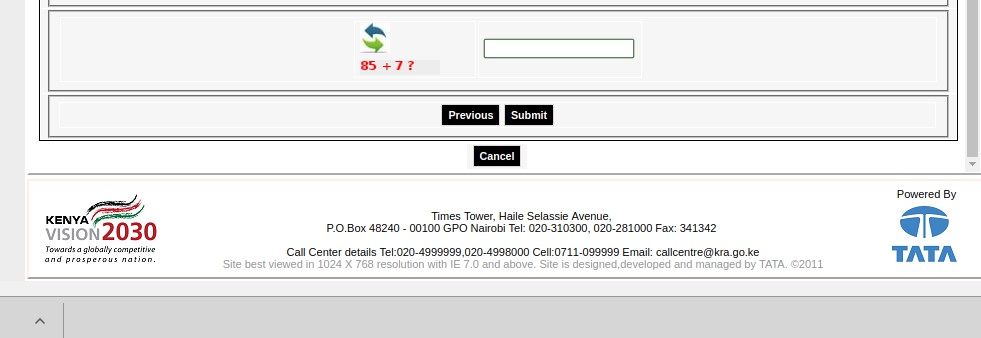

Enter results of the arithmetic sum provided and click submit

Check the email address you provided on your personal information for your KRA PIN certificate. The certificate can be printed for physical presentation.

One is required to have a pin for the following reasons;

1. When you wish to apply for students loan commonly known as HELB

2. If you are employed; Have a pin will help you pay your taxes and file for your returns every financial year.

3. If you have/wants to start a business;

4. Have rental incomes;

Requirements for a PIN registration

1. National IDs/ Alien ID card details - Ensure you have your National Id, that's if you're not sure of your personal details, your parents, and spouse if any. You'll need their details such as date of birth, Government name, place of birth and their National ID numbers to fill in the online form.

2. Employers' details, if employed - This includes their PIN, name of the employer, day time mobile number and a physical address

3. For those in business, you'll need business registration certificate details.

After obtaining all the above, visit itax.kra.go.ke, click on new PIN registration

For your business pin, on the type of tax, select non-individual, and for your personal use, select individual, on the mode of registration, select online upload as shown below, on completion, click next

In this next step you'll fill in your personal information, or Basic information as shown below, ensure all the tab on this page has correct information. That is the Obligation, source of income, and agent details. (Below picture shows individual taxpayer form)

Enter results of the arithmetic sum provided and click submit

Check the email address you provided on your personal information for your KRA PIN certificate. The certificate can be printed for physical presentation.

Last edited: