Cassey Tash

Lister

Hard financial times lead to borrowing from institutions which include but not limited to Banks, Mobile money lenders such as M-shwari, Fuliza, and KCB-Mpesa, digital money lending app such as Tala.

Every institution has its own terms and conditions in which one is expected to follow before and after receiving the loans. Some will ask for collaterals or guarantors, others will not, they use the information provided as security.

Once you have started lending money, you should constantly check for your CRB status to avoid error(s) in the future, paying your loans on time, improve your credit score and report.

CRB, (Credit Reference Bureau) is an agency that monitors and collects data on loans issued by lenders and create reports. Lending institutions use these reports to determine whether one is eligible for a loan(s) or not.

Central Bank of Kenya licensed three CRBs to share, manage and collect information of lendees. One is required to register for one or all the three since different lenders send information to different CRBs.

The CRBs include;

With Metropol, you first have to pay for registration fee which is Sh50 using Mpesa Paybill number 220388, enter your National ID number as your account number, and send.

After registration, you'll receive a text message with a PIN, reference number and a link.

Metropol has three methods in which one can check for their status, the methods are;

If the status result is Good, if it shows Good, it means you have a good rating at CRB if it shows 'blacklisted' it means you have defaulted your loan and have a bad rating.

Checking CRB status using TransUnion

With TransUnion, you can send a text to 21272 or down the app on the google app store.

Send a text to TransUnion costs Sh19 every time you check your status. Send your name full name and National ID number to 21272 and you'll receive your CRB status.

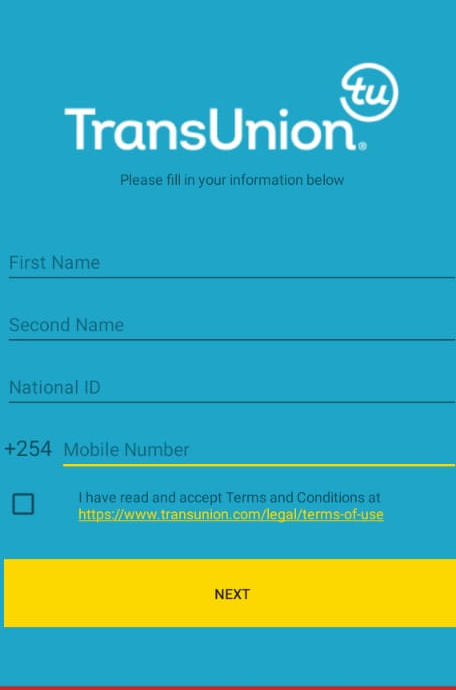

If you decide on using the TransUnion app which is absolutely free, download it on your phone, fill appropriately as demonstrated below;

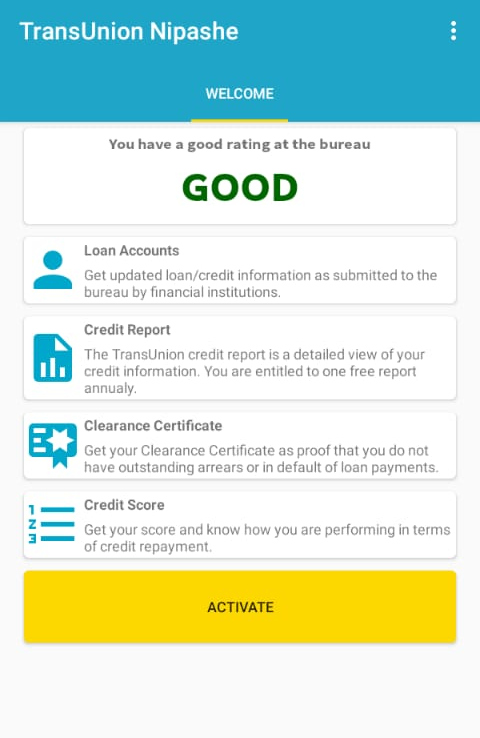

A page will pop up showing your CRB status, if it shows Good, it means you have a good rating at CRB if it shows 'blacklisted' it means you have defaulted your loan and have a bad rating.

You can also check for your loan accounts, credit report, get your clearance certificate and credit score using the TransUnion app.

Checking CRB status using CreditInfo

To check for CRB status using CreditInfo, one has to fill a form online through their website (ke.creditinfo.com).

Every institution has its own terms and conditions in which one is expected to follow before and after receiving the loans. Some will ask for collaterals or guarantors, others will not, they use the information provided as security.

Once you have started lending money, you should constantly check for your CRB status to avoid error(s) in the future, paying your loans on time, improve your credit score and report.

CRB, (Credit Reference Bureau) is an agency that monitors and collects data on loans issued by lenders and create reports. Lending institutions use these reports to determine whether one is eligible for a loan(s) or not.

Central Bank of Kenya licensed three CRBs to share, manage and collect information of lendees. One is required to register for one or all the three since different lenders send information to different CRBs.

The CRBs include;

- Metropol Corporation

- CreditInfo

- TransUnion

With Metropol, you first have to pay for registration fee which is Sh50 using Mpesa Paybill number 220388, enter your National ID number as your account number, and send.

After registration, you'll receive a text message with a PIN, reference number and a link.

Metropol has three methods in which one can check for their status, the methods are;

- Downloading Metropol app on google play store

- Use the USSD code *433#

- Visit their website (metropol.co.ke)

If the status result is Good, if it shows Good, it means you have a good rating at CRB if it shows 'blacklisted' it means you have defaulted your loan and have a bad rating.

Checking CRB status using TransUnion

With TransUnion, you can send a text to 21272 or down the app on the google app store.

Send a text to TransUnion costs Sh19 every time you check your status. Send your name full name and National ID number to 21272 and you'll receive your CRB status.

If you decide on using the TransUnion app which is absolutely free, download it on your phone, fill appropriately as demonstrated below;

- Enter your first name

- Enter your second name

- Enter your National ID number

- Input your phone number

- Check the terms and conditions checkbox

- Click next.

A page will pop up showing your CRB status, if it shows Good, it means you have a good rating at CRB if it shows 'blacklisted' it means you have defaulted your loan and have a bad rating.

You can also check for your loan accounts, credit report, get your clearance certificate and credit score using the TransUnion app.

Checking CRB status using CreditInfo

To check for CRB status using CreditInfo, one has to fill a form online through their website (ke.creditinfo.com).

Last edited: