wrongturn

Elder Lister

FIVE banks held ksh1.024Trn of GoK debts in 2021.

GoK appetite grew in 2021 v 2020

1. Equity- sh394.1B v sh217.4B

81%

81%

2. KCB - sh276.3B v sh210.8B

31%

31%

3. Co-op- sh184.1B v sh161.9B

13.7%

13.7%

4. Stanchart- sh91B v sh94.8B

4%

4%

5. ABSA- sh89.2B v sh87.1B

1.3%

1.3%

TOTAL-sh1.024T

How it impacted their P&L A/Cs:

Comparison of interest income from GoK debt, 2021 v 2020:

1. Equity - ksh29.45B v ksh20.93B

2. KCB - ksh26.5B v ksh23.1B

3. Co-op - ksh18.7B v ksh14.8B

4. Stanchart - ksh9.1B v ksh9.55B

5. ABSA - ksh8.9B v ksh8.2B

Total = ksh92.65B

Good business.

This level of domestic borrowing isn't without impacts. From bank's perspective, it's understandable. The Private sector is risky, GoK papers aren't. It's GoK that should be cutting its appetite for domestic borrowing & not banks restraining from making lucrative investments.

That said, the displacement of private sector from credit market - the crowding out effect is huge. Private sector credit growth remains below 10%. That's not optimal for growth necessary for sufficient growth & job creation.

Consistent job losses in last 9yrs doesn't surprise.

Something I can figure out on Big 5 data:

Customer deposits: ksh2.738T

Loans & advances: ksh1.9337T

Difference = ksh804.3B

But they hold ksh1.024T in GoK debts

***

Investment in GoK debt/Total assets ratio

Equity -30.2%

KCB -24.2%

Co-op -31.75%

Stanchart -27.1%

ABSA - 20.8%

*Error of omission.

NCBA actually comes ahead of stanchart & ABSA in size of GoK debt & interest income from this holding.

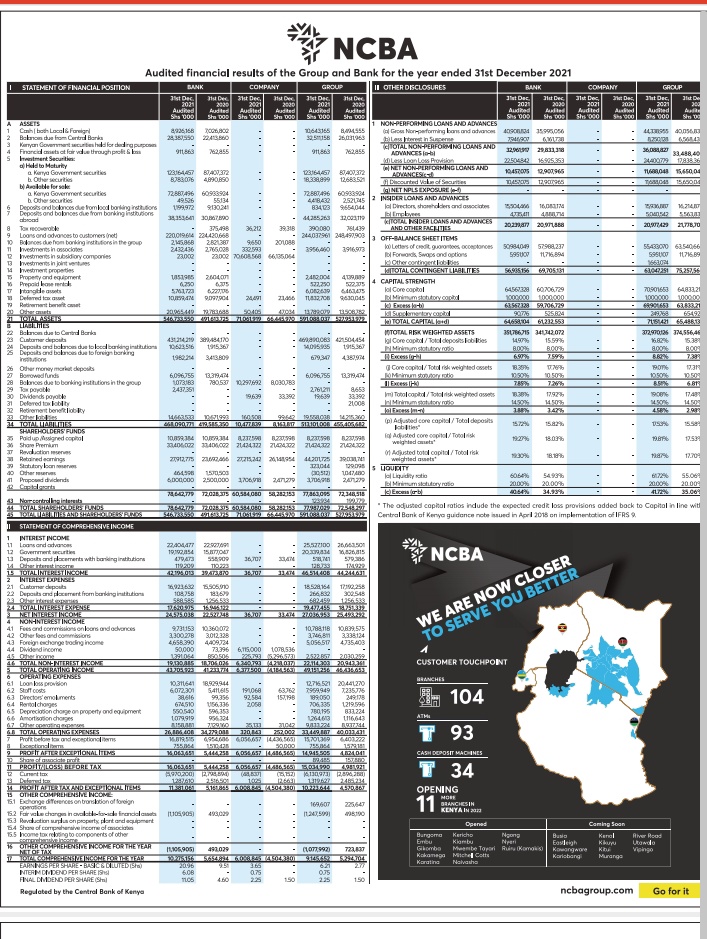

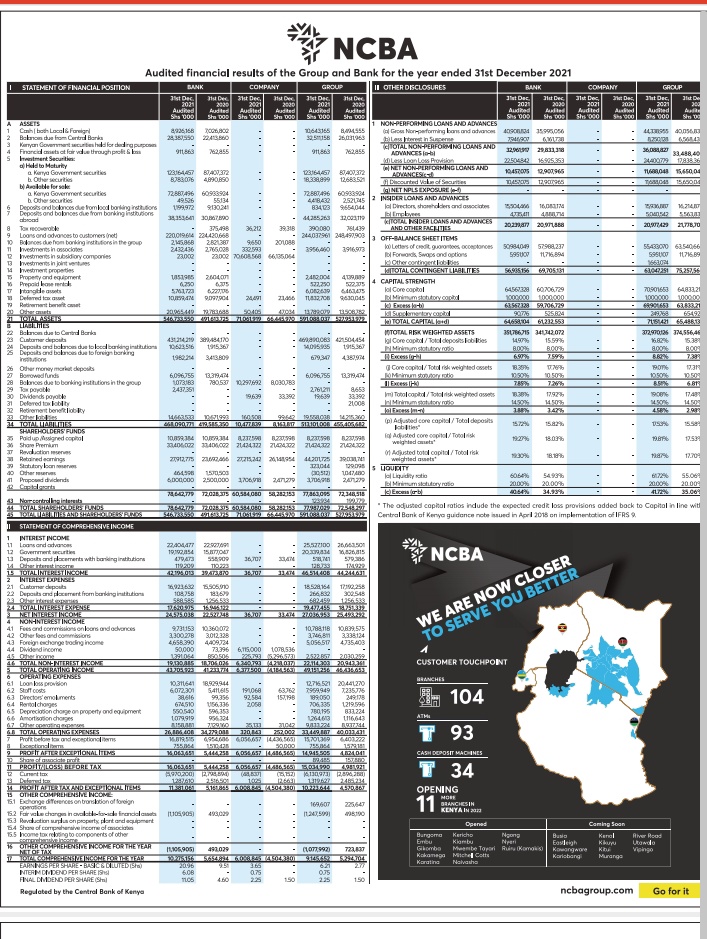

NCBA:

Loan-deposits ratio - 51.94%

GoK debt holding - ksh123B v sh87B 41.3%

41.3%

Interest from GoK debt sh19B v sh15B

GoK debt - total assets ratio -26.1%

Including omitted NCBA,

The top six banks - in GoK debt holding.

1. Equity - sh394.1B

2. KCB - sh276.3B

3. Co-op - sh184.1B

4. NCBA - sh123.1B

5. Stanchart - sh91B

6. ABSA - sh89.2B

Total = sh1.147T

Total interest earned=sh111.75B = GoK interest expense

Also interesting, despite Co-op's significantly higher investment in govt securities, interest income is lower.

Investment in govt securities:

Co-op - sh184.1B

NCBA - sh123B

Interest income:

Co-op - sh18.7B

NCBA - sh19.1B

GoK appetite grew in 2021 v 2020

1. Equity- sh394.1B v sh217.4B

2. KCB - sh276.3B v sh210.8B

3. Co-op- sh184.1B v sh161.9B

4. Stanchart- sh91B v sh94.8B

5. ABSA- sh89.2B v sh87.1B

TOTAL-sh1.024T

How it impacted their P&L A/Cs:

Comparison of interest income from GoK debt, 2021 v 2020:

1. Equity - ksh29.45B v ksh20.93B

2. KCB - ksh26.5B v ksh23.1B

3. Co-op - ksh18.7B v ksh14.8B

4. Stanchart - ksh9.1B v ksh9.55B

5. ABSA - ksh8.9B v ksh8.2B

Total = ksh92.65B

Good business.

This level of domestic borrowing isn't without impacts. From bank's perspective, it's understandable. The Private sector is risky, GoK papers aren't. It's GoK that should be cutting its appetite for domestic borrowing & not banks restraining from making lucrative investments.

That said, the displacement of private sector from credit market - the crowding out effect is huge. Private sector credit growth remains below 10%. That's not optimal for growth necessary for sufficient growth & job creation.

Consistent job losses in last 9yrs doesn't surprise.

Something I can figure out on Big 5 data:

Customer deposits: ksh2.738T

Loans & advances: ksh1.9337T

Difference = ksh804.3B

But they hold ksh1.024T in GoK debts

***

Investment in GoK debt/Total assets ratio

Equity -30.2%

KCB -24.2%

Co-op -31.75%

Stanchart -27.1%

ABSA - 20.8%

*Error of omission.

NCBA actually comes ahead of stanchart & ABSA in size of GoK debt & interest income from this holding.

NCBA:

Loan-deposits ratio - 51.94%

GoK debt holding - ksh123B v sh87B

Interest from GoK debt sh19B v sh15B

GoK debt - total assets ratio -26.1%

Including omitted NCBA,

The top six banks - in GoK debt holding.

1. Equity - sh394.1B

2. KCB - sh276.3B

3. Co-op - sh184.1B

4. NCBA - sh123.1B

5. Stanchart - sh91B

6. ABSA - sh89.2B

Total = sh1.147T

Total interest earned=sh111.75B = GoK interest expense

Also interesting, despite Co-op's significantly higher investment in govt securities, interest income is lower.

Investment in govt securities:

Co-op - sh184.1B

NCBA - sh123B

Interest income:

Co-op - sh18.7B

NCBA - sh19.1B